2013 Season of Shopping Insights 2: Insights Across America

Continuing our series on “2013 Season of Shopping Insights,” we analyzed shopping behavior in the top 50 cities across the US (including mobile share of views, and mobile share of sales) and uncovered some regional shopping patterns—and anomalies—that may surprise you.

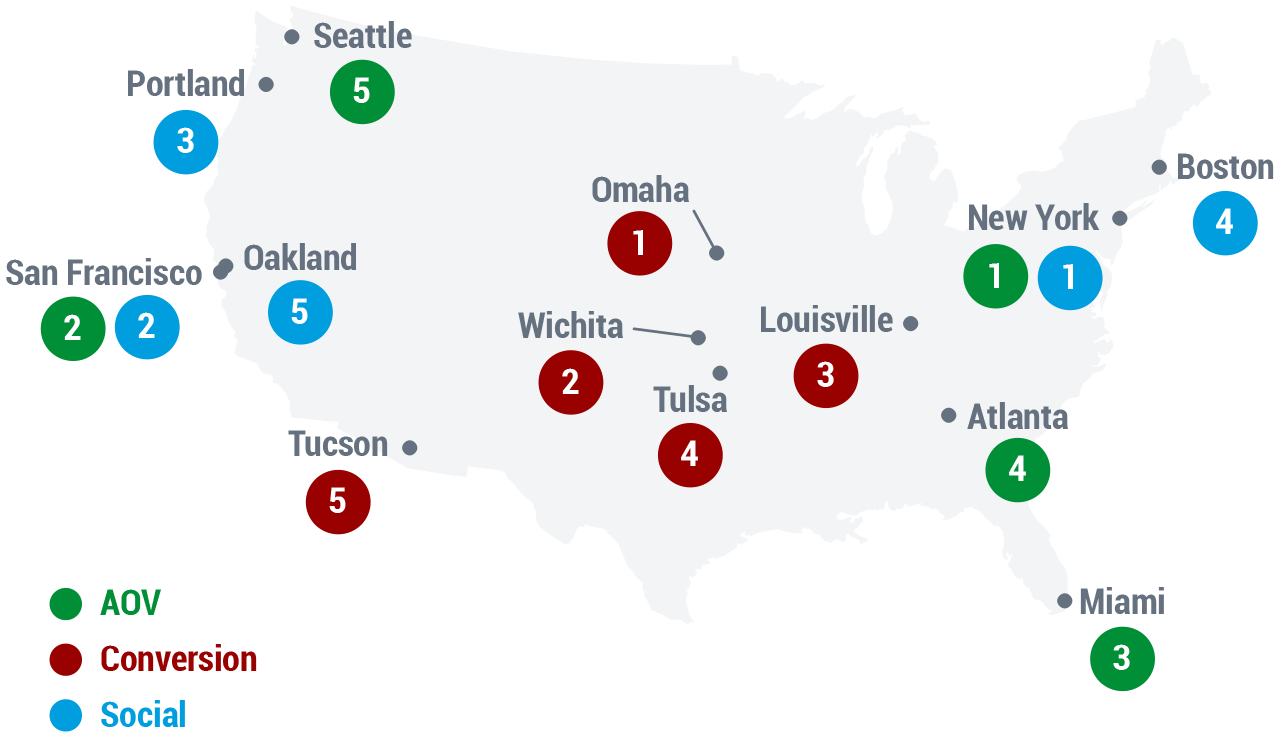

Which cities lead the way when it comes to conversion, AOV, and social activity? What are some key shopping trends in our great states of Texas and California?

Top 5s

| AOV | Conversion Rate | Social Referral Percentage |

|

|

|

Texas Trends (AKA Austin “Oddities”)

- Mobile Sales. Mobile accounted for over a quarter of sales in Dallas, and over 20% in Houston, but was merely average in El Paso and Fort Worth. Surprisingly, Austin lags in mobile.

- Shopping Behavior Similarities. Dallas, El Paso, Fort Worth, and San Antonio are all similar, but Austin—once again the odd one out—is closer in shopping behavior to Portland than its Texas sister cities.

California: Coastal City Surprises

California: Coastal City Surprises

- Long Beach is closer in overall shopping behavior to Phoenix than to LA.

- San Francisco is more like Atlanta than like Oakland in its shopping behavior. (SF has higher AOV, but Oakland has the greater share of mobile traffic and sales.)

Methodology: This study uses data about the top 50 US cities (by population) from over 100 sites on Thanksgiving Day (2013-11-28). The data consists of over 5.5 million sessions and 200 thousand orders.

More from the 2013 Season of Shopping Insights series:

- Shoppers Less Responsive to Retailers’ Day-Specific Promotions though Cyber Monday Gains Ground

- Insights Across America