About 15 years ago, I was working for a little marketing agency creating banners and ads for websites. On average, a client had around 10-12 such banners. The rule of thumb was that if a banner was relevant to about 80% of the audience, we’d build it. A “20% off everything“ for everyone campaign would surely meet this criteria. Building a banner targeted to a handful of shoppers was simply not done, it was unthinkable.

You spend a lot of time optimizing your website to streamline the shopper’s path through the retail funnel—making sure they see value at each point along the way. Once you navigate the shopper to the right product, it’s important that you take the necessary steps to seal the deal, and get the shopper across the finish line.

The cart page is a pivotal area for securing that conversion. When done well, you’ll get the sale, and then potentially entice the shopper to buy more items. When done poorly, you’ll disrupt conversion by distracting the shopper from the transaction you’ve fought so hard to get.

And so we ask: How smart is your cart?

At RichRelevance, we’re sensitive to the cart page experience, and work closely with our retail partners to implement solutions deep in the funnel that will grow cart values without compromising conversion. Here are three things you can do with product recommendations to substantially enhance your cart page experience:

1. Get out of the way

Securing conversion is our primary objective on the cart page. If we can get the shopper to buy more stuff and grow the order value, that’s phenomenal! But, it shouldn’t compromise completing the sale. The location of recommendations must reflect this prioritization and not interfere with the shopper consuming information critical to the buying decision.

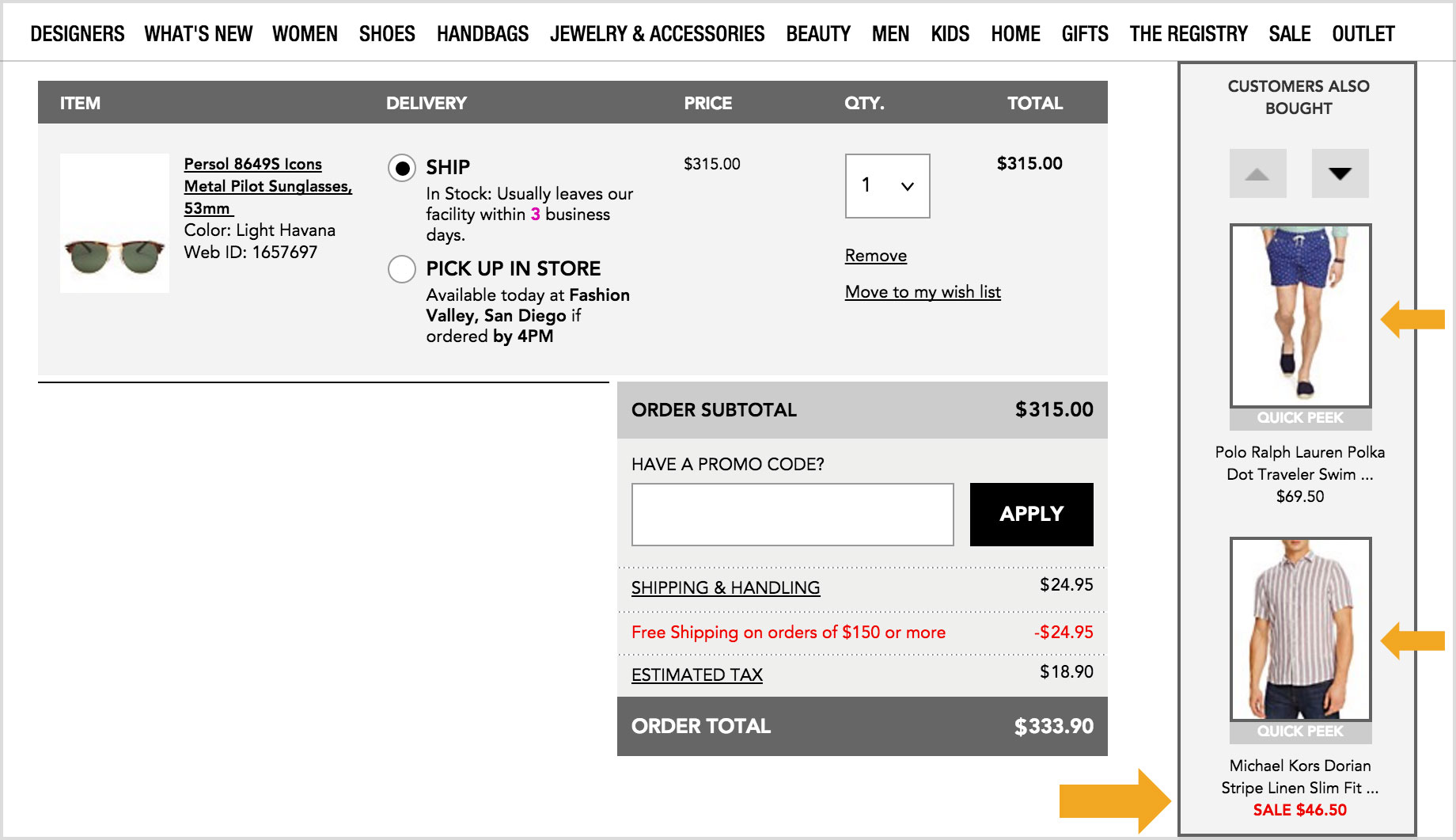

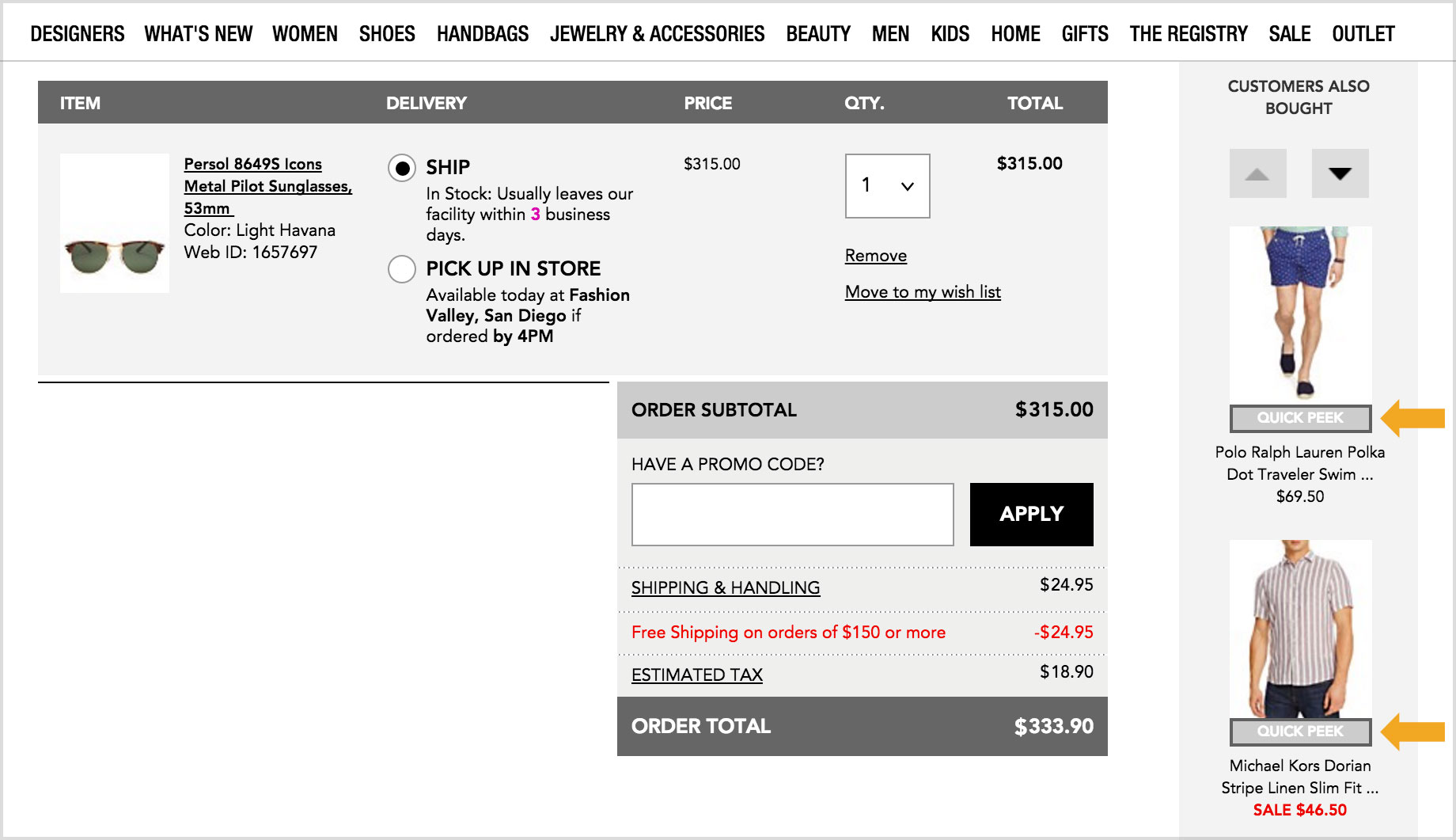

As such, recommendations must be on the periphery of core content such as the cart summary, checkout call-to-action, promotional code inputs, and other key messaging and functionality. This usually means slotting a vertical placement in the right margin or a horizontal placement underneath the main content area. Otherwise, if more prominently placed, you’re baiting customers to continue shopping, which can be extremely disruptive to conversion.

2. Recommend complementary, non-competitive products

When you finally get the shopper to the cart page, it’s critical not to challenge their decision to buy. If they add a TV to their shopping bag, they’ve demonstrated a degree of commitment that we shouldn’t impede by recommending another TV upon landing on the cart page. Instead of being helpful, that would be frustrating to the shopper, and elicitreconsideration at a point when a shopper should be firm about their core purchase

On the cart page, it’s imperative to use cross-sell recommendations that display products most often purchased with the seed item. However, since these kinds of recommendations rely on purchase behavior at the individual product level, something that happens much less frequently than browse activity, , it can be challenging for behavioral recommendations systems to always deliver intuitive cross-sell recommendations across a retailer’s entire catalog.

As an example, if a specific TV model has only been purchased 50 times in recent history, that’s probably not enough transactions to reliably identify four or five logical products that are commonly purchased with it. You can overcome this dilemma, in 2 ways:

I. Incorporate point-of-sale (POS) data in recommendations. If you have a brick-and-mortar presence, you probably have more offline POS transactions than online sales. Incorporating those in your online recommendations will provide a wealth of data from which to identify logical product associations.

II. Employ rule-based recommendations. Create a set of advanced merchandising rules that governs what is recommended in cross-sell situations. For each category of products, define what categories you want represented in each recommendation slot—and then let the engine source products based on whatever brand, attribute or compatibility-matching requirements you might have configured.

Ok, so now you have well-placement recommendations and you’ve optimized your cross-sell assortment across your entire catalog. What’s left?

3. Optimize your recommendations layout

Once you’ve gotten the shopper to the cart page, create inertia that pushes them through the checkout process rather than casting them out to higher parts of the funnel. You can do this by presenting a recommendation layout that facilitates exploring a product and adding it to cart without leaving the current page. Implement ‘quick view’ functionality on recommendations that allows a shopper to access product information, configuration options (e.g., size/color), and add-to-cart capabilities with a single click. Without this functionality, you’re forcing shoppers to leave the cart page to explore recommended products, and they may never come back.

Your cart page is sacred as it’s the gateway to more cash in your coffers. It’s imperative that the page experience drive shoppers to transact rather than pull them into a dangerous loop of product reconsideration. These are merely a small sample of tactics RichRelevance has deployed and validated using rigorous A/B and multivariate testing. We strongly encourage you to consider these optimizations for your retail site. They’ll make your cart smarter, protect your conversions, and grow your order values.

Today, we released our new study of more than 1,000 U.S. consumers, highlighting shopping preferences and sentiment this holiday season. One common theme that emerged is that Americans continue to be all about “instant gratification”; even benefits like Amazon Prime can’t top the pleasure and convenience of a purchase in-hand at check out.

But when shoppers visit the store is starting to matter. REI’s bold move to #OptOutside on Black Friday—closing its doors and website and paying its 12,000 employees to go outside—reflects they primary sentiment we found in our survey: Two-thirds of respondents disliked retailers being open on Thanksgiving Day.

Whatever your thoughts are about the kick off to the holiday shopping season, the store remains the centerpiece for consumers. In fact, retailers that implement simple digital innovations to meet the increased volume and needs of shoppers this season will reap big rewards, sealing the fate of the brick-and-mortar store as a key competitive advantage.

This holiday, the number one reason that Americans will head to the store is to get an item immediately. But long lines at checkout mar the experience. In fact, 73% of respondents cite this as their biggest frustration. What can stores do to deliver immediate satisfaction and convenience? Mobile check-out in store and click-and-collect were cited as welcome innovations.

Once in store, U.S. shoppers (thanks to smart phones), are increasingly self-sufficient—and impatient—when stores fail to deliver the same convenient, seamless experience they have online. Over half of Americans cited out-of-stock or unavailable items as a main frustration, while 1 in 5 are frustrated by sales associates who can’t help them find what they need, inconsistent pricing and items that don’t match what was researched online. The good news: consumers welcome a digital fix to these shopping woes. For 4 in 10 shoppers, self-service kiosks to check pricing, availability and product recommendations were cited as one of the most valuable store features this holiday.

As the lines between online and offline shopping continue to merge, the store remains more than a holiday tradition. New digital technologies and advances in in-store personalization can address nearly all of the frustrations shoppers experience in store. This is welcome news for traditional retailers as they strive to gain the operational, marketing, merchandising and “instant gratification” edge in their battle with Amazon this holiday and beyond.

I invite you to check out our full survey results here.

Essential eCommerce speaks to VP and general manager of EMEA at RichRelevance, Matthieu Chouard, about the importance of personalising the customer journey.

Personalisation is a technology at the top of most retailers’ minds. The ability to provide a bespoke, even boutique-style, service in order to stand out from the competition is clearly a clever move and this starts by simply recommending products online based on a customer’s taste.

“If you want to make your customer happy, you have to make them understand they are unique and not part of a customer segment,” VP and general manager of RichRelevance EMEA, Matthieu Chouard, tells Essential eCommerce.

Transformation is everywhere we look in ecommerce. While some verticals adapt readily to transformation (like books, electronics and fashion), others resist or struggle with change. One vertical that struggles is online grocery. Online grocers blame difficult delivery, low margins, and lack of adaptation from customers for slow growth.

Amidst rapid change, we sometimes forget important lessons from the past. Groceries were actually the very first vertical that sold online. Well, it was not quite online as we hardly had electricity back then, but the milkman delivered milk every morning to our grandparents and great-grandparents based on a simple subscription order.

Indeed, we can look to the milkman model to help solve the online grocer’s struggles. It incorporated solutions for delivery, while addressing low margins and lack of adaptation—and made it all work marvelously. Let’s take a closer look.

Difficult delivery. Online supermarkets claim it’s not that easy to deliver perishable goods (as compared to non-perishables such as a computer mouse or a new sweater). If a home delivery is requested, there’s always the possibility that the shopper is not at home, which is often true if you deliver at 2:00 PM, since most of us work at this time. Milkmen used to get up notoriously early in order to complete deliveries before breakfast. People could rest assured that each time they opened the door in the morning, a new bottle of milk was waiting for them. The lesson? Don’t deliver at random hours using parcel delivery services. Use a regular, familiar delivery network which can be relied upon to deliver groceries early in the morning. That’s not to say there are no other viable options: in-store pick up and home delivery at chosen time slots are still worthwhile alternatives which should be pursued.

Low Margin. Compared to other verticals, grocers indeed work off a low margin, for multiple reasons. So did the milkman. But he knew exactly how much money he would earn the next day. The lesson we learn from the milkman is to offer products via a subscription service. Most things we buy in supermarkets are products we buy over and over, like coffee, cheese, cereals, orange juice …or milk. These are so called replenishment products that are bought again and again, with customers frequently remaining faithful to the product and brand. Good personalization engines can recognize these products with ease. If these are offered in a subscription service, the business model changes to a constant and predictable revenue stream. Once somebody is hooked on a subscription, their likelihood of discontinuation is significantly lower—almost zero. Consequently, the marketing costs for this product drastically fall—also to about zero. As long as the shopper remains subscribed, their reactivation cost is exactly zero. All the foundational investments made by every supermarket chain evaporate once a customer is turned into a subscription customer, so you can expect margins to increase. But beware: growing the customer base and margins at the same time won’t work. Acquire customers first, then once critical mass is achieved, turn the margin knob.

Lack of adaptation. Groceries are inherently a local business. People not only eat differently in the North than in the South, they also have different shopping habits. While the British prefer to do their shopping once a week at a hypermarket at the city limits, Germans will run almost every day to their little supermarket across the street. Obviously it’s easier to persuade British shoppers to buy online than Germans. Numbers prove that while about 24% of the groceries in the UK are purchased online, less than 1% of the Germans choose to buy their food online. The big supermarket chains (the usual suspects) don’t get it because they still rely on a single purchase model. Those who are overcoming this hurdle are new players who distribute meals based on subscription. HelloFresh, a German fresh ingredient box delivery service, is widely popular. They don’t have customers, they have members. Every week, members receive a box with new ingredients and new recipes to try out. And it’s not just Germany where these services have sprung up to take on a market that is supposedly slow to adapt: Blue Apron, Plated and Marley Spoon are just a few similar services. Their secret to success lies in their business model. I call it “groceries as a service.“ What’s the lesson we learn from these new services? While shopping at an online supermarket, the purchase decision has to be made each time, but with a subscription service, the shopper needs to make it only once. And once the subscription runs, the adaptation has already taken place.

No other vertical is as ripe and ready for subscription services as groceries. With today’s technological advancements, we can bring the milkman back and let him deliver more than just a couple of bottles of milk. Let him deliver all of our groceries.

RichRelevance Founder Dave Selinger is featured on “The 2000s: A New Reality,” premiering Sunday, July 12, 9 PM EST on the National Geographic Channel.